BRICS: U.S. Dollar Sliding 10 Times Faster Than Last 2 Decades

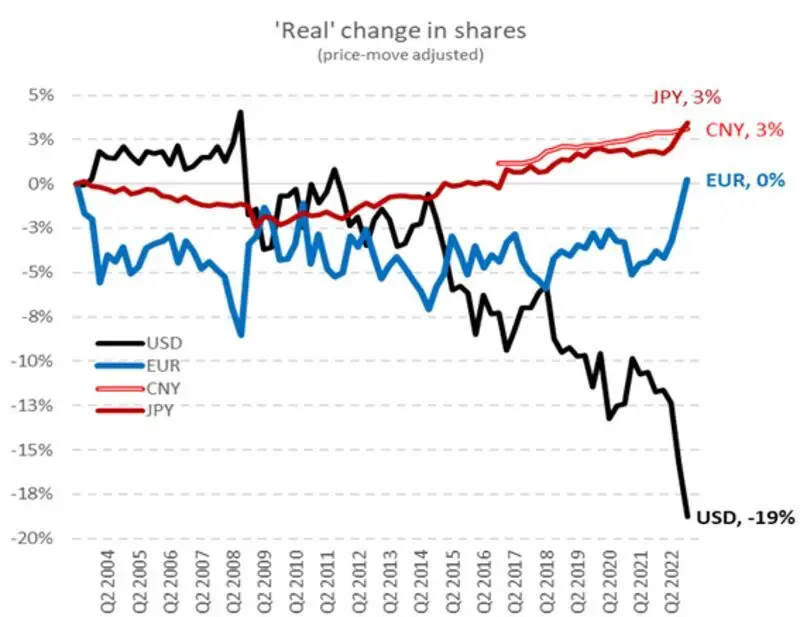

According to the latest report by Bloomberg, the U.S. dollar is sliding 10 times faster than the last two decades. The U.S. dollar now represents about 58% of the global reserves, down from 73% in 2001. Developing nations’ experimenting with the de-dollarization initiative is speculated to currently lead dollar’s decline. The dollar has dropped nearly 15% in the last two decades and continued to slide with fears of an upcoming BRICS currency.

Also Read: Will Canada & Mexico Join BRICS To Eliminate U.S. Dollar’s Dominance?

Since 2016, the dollar lost nearly 11% of its market share. Developing nations’ replacing the USD for international trade picked up steam making the dollar face threats of a global collapse.

BRICS: Why Is the U.S. Dollar Falling?

Exceptional actions by China and Russia challenged the dollar’s hegemony and are pulling other nations towards their side. The development has startled the U.S., as European countries are buying laundered oil from Russia through Saudi Arabia. France also paid the Chinese Yuan to settle an LNG gas trade with China. Therefore, not only developing countries, but European nations are also looking at ways to sideline the dollar.

Also Read: BRICS Countries Buying Large Amounts of Gold To Topple the U.S. Dollar

Moreover, the BRICS nations China, Russia, and India are stocking up tonnes of gold instead of the dollar, reported the World Gold Council. The three nations combinedly purchased nearly 135.9 tonnes of gold during Q1, 2023. It is reported that the new BRICS currency could be backed by gold and not the U.S. dollar.

If BRICS internationalizes its upcoming currency, the dollar may plummet and lose its global reserve status. America would have no option to fund its deficit, and its economy could face tremors. While the dollar has already lost its shine, more pressure on the greenback could eliminate its global clout. The next BRICS meeting in August 2023, in South Africa could seal the fate of the U.S. dollar’s prospects.

Comments

Post a Comment