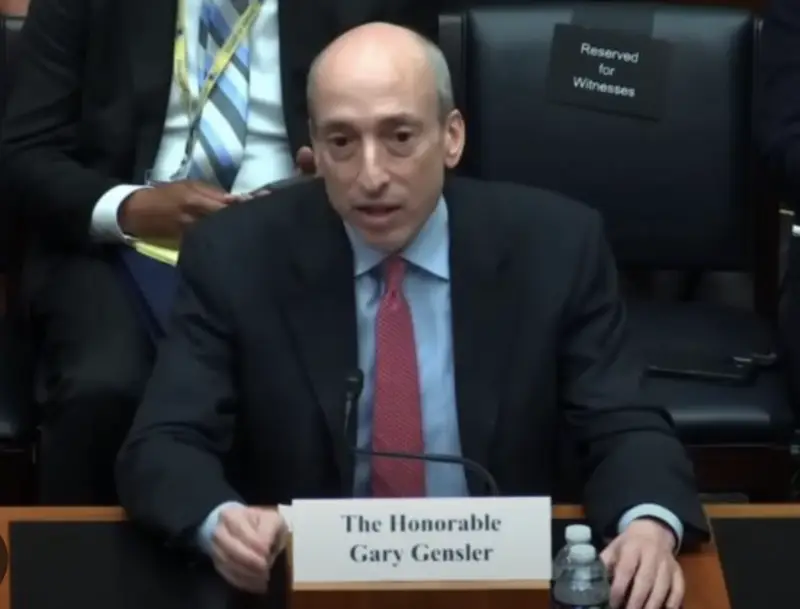

U.S. House Committee Chairs, Blockchain Association Turn Up Heat on SEC Head Gensler

Join Our Telegram channel to stay up to date on breaking news coverage

Three committee chairs in the United States House of Representatives have sent a letter to Gary Gensler, chairman of the United States Securities and Exchange Commission (SEC). The letter demands a more satisfactory response to a November 1 question regarding the SEC and its chairman’s compliance with recordkeeping requirements.

Simultaneously, the Blockchain Association, a lobbying group for the American cryptocurrency industry, is advocating that Gensler steps down from enforcing regulations on the crypto sector. The Association has said that his public remarks have demonstrated that he lacks objectivity in his Analysis of the problems.

Who is Gary Gensler and Why Is He Facing the Brunt of the Crypto Community?

Gary Gensler currently heads the Securities and Exchange Commission of the United States. Gensler was sworn into office on April 17, 2021, having been nominated by President Joe Biden in February, and then confirmed by the Senate. Gensler oversees fair, orderly, and efficient markets, facilitating capital formation, safeguarding investors, and fostering public confidence in the market.

Crypto aficionados have often referred to Gensler as the “ringleader” of the shambolic SEC reaction to the industry in recent months. Especially when contrasted to his predecessors, he is renowned for taking a tough stance on the cryptocurrency business.

Conflicts may arise to the extent that advisers or brokers are optimizing for their own interests as well as others. Further, the underlying data used in these analytic models could be based upon data that reflects historical biases, affecting fair access & prices in the markets.

— Gary Gensler (@GaryGensler) June 28, 2023

While many Democrats have backed Gary Gensler in his efforts to shut down cryptocurrency exchanges, Gensler has come under fire from Republicans. On June 13, Warren Davidson, a congressman from Texas, introduced a bill called the SEC Stabilisation Act that would reorganize the agency and oust Gensler as chairman.

Check out our list of the best AI cryptos to buy.

Questioning from the House of Representatives

Jim Jordan, James Comer, and Patrick McHenry, the chairs of the Judiciary, Oversight, and Financial Services committees, respectively, had specifically demanded confirmation that the SEC complies with federal recordkeeping and transparency regulations, that Gensler and his deputies haven’t used personal email accounts to conduct business, and explanations of the agency’s definition and application of “off-channel communications.”

They have noted that Gensler’s response to their inquiry didn’t directly respond to their letter’s requirements. Inconsistencies in Gensler’s publicly available meeting schedules through 2021 have also been mentioned in the letter.

In addition to restating the original demands, the new letter adds, “If you do not intend to comply with any or all of the above requests #1-5, please describe the factual and legal basis for your non-compliance.”

The next day, the Blockchain Association published a document saying that Gensler should abstain from making decisions about the enforcement of digital assets, which made Gensler the target of criticism especially related to the cryptocurrency industry.

Critique by The Blockchain Association

The Blockchain Association released a critical statement in the form of an open letter, talking about the SEC and Gary Gensler’s rigid stance, and its detrimental effect on the promising cryptosphere.

“His steadfast view that all digital assets except bitcoin are securities means that he cannot approach enforcement decisions with a fair and impartial mind,” noted Jake Chervinsky, Chief Policy Officer of the Blockchain Association, in the open letter about Gensler.

“In the digital asset space, the SEC has all but abandoned its role as a rulemaking body. Key issues of existential importance to the digital asset industry remain unresolved, chief among them the question of whether and when a digital asset represents a ‘security’”, the paper notes.

1/ SEC Chair Gary Gensler has wrongly prejudged that all digital assets are securities.

As a result, federal law requires that he recuse himself from all enforcement decisions related to digital assets.@MTCoppel and I wrote a paper explaining why 👇https://t.co/xgJ09o4SPS

— Jake Chervinsky (@jchervinsky) June 29, 2023

According to the statement, citing several speeches made by the SEC chairman, Gensler “has clearly stated his view” that all digital assets other than Bitcoin are unregistered securities and all digital asset trading platforms are unregistered securities exchanges.

The letter continues, “Due process requires not only that agency decision-makers act without bias, but also that they avoid even the appearance of bias.” These words demonstrate Gensler’s prejudgment of “everything other than Bitcoin,” it notes.

The article also reminded that anybody who received a Wells notification might ask the SEC or a federal court to revoke Gensler’s immunity.

The Blockchain Association’s statement comes as a follow-up to crypto exchange Coinbase Inc’s notice of intent on Wednesday, asking a court to dismiss the SEC’s actions against its business.

SEC Coming Down on Crypto Exchanges

The US SEC had filed a lawsuit against Coinbase on June 6 on the grounds that the exchange was using the trading platform as an unlicensed broker and exchange of financial assets. A day earlier, the SEC had sued Binance.US for the same reasons.

In a statement, Coinbase claimed that the SEC was well aware of the exchange’s operations involving digital assets as a result of its registration for a public offering in April 2021. When the SEC examined Coinbase’s public offering registration, six of the twelve cryptocurrencies it had deemed securities were already traded there.

Asserting that the SEC is attempting to ensure that financial markets are fair and effective, Gensler has defended his strategy. He claimed that he is attempting to lower the cost of financial intermediaries, a strategy that is bound to irk many.

Related

- South Korea Pushes Crypto Bill to Address Unfair Trading

- SEC Dismisses BlackRock and Fidelity ETF Proposals

- Best Crypto Presales

Wall Street Memes - Next Big Crypto

- Early Access Presale Live Now

- Established Community of Stocks & Crypto Traders

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Best Crypto to Buy Now In Meme Coin Sector

- Team Behind OpenSea NFT Collection - Wall St Bulls

- Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

Comments

Post a Comment